•

A Guide to Identifying Good Investment Properties in Real Estate

An investment property is a real estate property purchased to generate income or revenue, either as a rental property, a second home, or a fix-and-flip…

An investment property is a real estate property purchased to generate income or revenue, either as a rental property, a second home, or a fix-and-flip property. Investment properties can become a form of passive income and an asset type that can aid in providing financial freedom.

If you’re navigating the real estate investing world for the first time, understanding what makes a good investment property is crucial. Choosing the right property ensures you make a positive return on investment (ROI) and can sustainably grow your portfolio for the future.

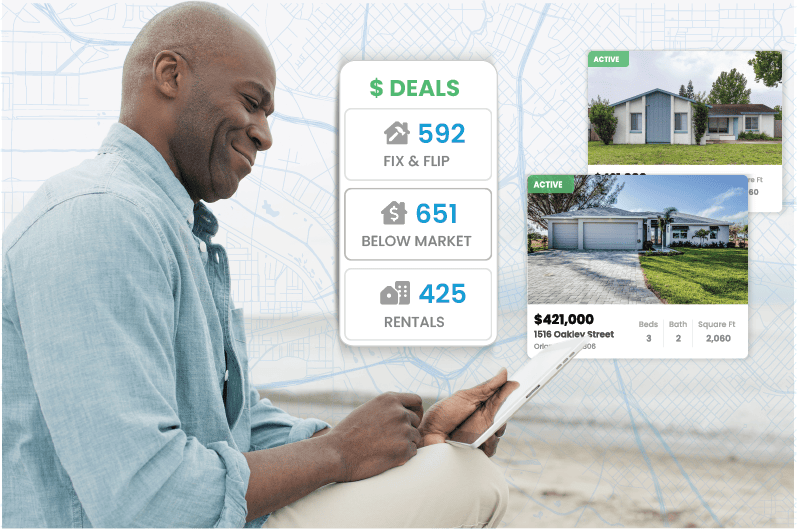

At Privy, our comprehensive real estate investing platform is designed for real estate investors at every stage in their journey. Our intelligent investor filtering and analysis minimize risk and maximize profit on every investment. This guide takes an in-depth look at identifying good investment properties for investors who are just starting and seasoned investors seeking to diversify their portfolios.

What is an Investment Property?

An investment property is real estate purchased with the intent to earn a return through rental income, resale, or both. These real estate properties fall into three main categories: residential, commercial, and mixed-use properties. An investment property may be purchased and managed by an individual investor, partnership, or a real estate investment trust (REIT).

An investment property doesn’t need to be held long-term. Every investor will have their own strategy in mind. Some may decide to hold an investment long-term to benefit from property appreciation or purchase a second home to earn income from as a part-time vacation rental.

Short-term investments typically involve remodeling, making repairs, and renovations to bring the property up to market quality. These properties are known as fixer-uppers, with the investor ‘flipping’ the property within a short window before putting it back on the market for a higher price after making improvements. The goal of a fixer-upper is to sell the property within a short time frame for a profit.

Investors may seek professional advice to determine the best use of a property, such as whether it should be used to generate rental income or redeveloped into multi-family units. Market trends and the local real estate market can help determine the most profitable option for an investor.

Types of Investment Properties

There are three main types of investment properties, which each offer their own pros and cons. While an investor may focus on one of these industries, diversification is the best way to minimize risks and optimize an investment strategy.

1. Residential

Residential properties are often an entry point for investors with a range of property types to choose from. Residential properties can be vacation rentals, single-family homes, and multi-family units. Investors may choose to start with rental properties to gain liquidity with rental revenue and build their portfolios. This could be in the form of long-term rentals or short-term rentals. But you can also fix and flip residential properties as well. These properties can be apartments, condominiums, townhouses, or individual houses.

2. Commercial

Commercial properties are used for business purposes, typically as office spaces. While these properties have higher maintenance costs involved, they often generate a higher rent per square foot than residential properties. Therefore, the higher costs are offset by increased revenue. Commercial properties can also be used for retail stores, restaurants, and any other form of business operations.

3. Mixed-Use

Mixed-use properties are used for both residential and commercial purposes. However, it’s rare to find these types of buildings, and they are typically found in high-value city areas.

A building can be mixed-use when part of it is used for business operations, such as for a store or restaurant, while the other part is used for residential units. Typically, these residential units will be located on a higher floor, while the commercial units are on the ground and lower floors.

Ownership Structures for Investment Properties

There are various ownership structures an investor can choose to use when entering the industry. Individual ownership, partnerships, and real estate investment trusts (REITs) are the most popular options. Ownership structures can be divided into direct and indirect real estate investment categories.

A direct real estate investment is when the investor is personally involved in managing the properties and owns them themselves. By comparison, an indirect real estate investment is when there are multiple investors involved who pool their capital together to purchase and manage properties.

With individual ownership, investors generate revenue through rental incomes and property appreciation. They have the freedom to choose what to do with the property, whether they want to use it to generate rental income or live in it part-time while also leasing it as a vacation rental.

By comparison, real estate investment trusts (REITs) operate and own real estate properties on behalf of multiple investors. This option is ideal for investors who want to have a hands-off approach to property management and earn rental income without buying or financing the property themselves. REITs were introduced in the 1960s and have become a popular option for indirect property investment.

REITs can be divided into three major categories based on the type of property they invest in:

- Equity REITs: most REITs will fall into this category as they own and manage real estate that generates income and revenue. These REITs focus on rental properties, rather than flipping properties and reselling for a higher price after making repairs and renovations.

- Mortgage REITs: these REITs lend money to real estate operators with financial instruments, such as loans and mortgages. The REIT generates revenue through the interest they earn from these loans.

- Hybrid REITs: these REITs are rare to find as they primarily operate before the 2008 financial crisis, adopting dual strategies of equity and mortgage REITs.

Characteristics of a Good Investment Property

There’s more to consider when choosing an investment property than just the property itself. There are several characteristics to consider that will determine a property’s potential rental income and market value. Understanding these characteristics can help you identify potential properties to invest in that match your investment strategy with a lower-risk profile.

1. Location

Location is everything in real estate. Potential renters and buyers often focus their search on desirable neighborhoods in certain school districts and with nearby amenities. Similarly, properties in high-employment areas are more likely to attract buyer interest and obtain a higher price.

Consider the possible tenants you’re likely to encounter in the area the property is located in. If you invest in a property near a university, for instance, you may be likely to have student tenants.

2. Property condition

A property’s condition matters as it determines what type of investment you are making. Most properties require at least minor repair and maintenance before being put on the market as a rental property or vacation rental.

However, fixer-uppers are properties in poor condition and on the market at a lower price point. Investors can carry out repairs and renovations to earn a higher profit by ‘flipping’ the property or putting it on the market for a higher rental income.

3. Cash flow potential

Investors need to have positive cash flow. There are a significant number of costs associated with a property, from paying property tax to utilities and overseeing property maintenance.

Most investors will take out a mortgage against their property and need to generate enough income to pay for this. Positive cash flow ensures that the rental income generated from the property exceeds the associated expenses.

4. Appreciation potential

Investors may hold onto a property long-term due to its appreciation potential. Many investors start by using their property to generate rental income before selling the property after it reaches its appreciation potential. Investors can use market trends and local market insights to determine if planned infrastructure developments and potential economic growth may drive demand for properties.

5. Market trends

Investors must understand the local market to identify trends that may impact property appreciation or the revenue they can generate from an investment property. Tools like Privy can help determine rental demand, property appreciation rates, and the market price of similar properties.

6. Tenant demographics

A good real estate investment will attract reliable tenants who can ensure consistent rental income. Desirable tenant demographics could include professionals and dual-income families, as they are likely to become long-term tenants, reducing the additional expense of advertising rental properties and having an empty property.

A location with strong employment opportunities is likely to offer ideal tenant demographics. Research what the average income is in the area to determine what professionals are likely to be willing to pay for a rental property.

7. Future development

If you’re looking for long-term investments, future development in the local area can indicate a good investment opportunity. Speak to the local planning department to determine what developments have already been approved for the future. Developments that offer more amenities, such as public parks, transportation links, and restaurants, can make an area more desirable and increase property prices.

Types of Properties that Make Good Investments

Most investors start with a particular property type in mind. There are five property types that make a good investment in almost any location and suit investors with different risk profiles and financial resilience.

1. Single-Family Homes

These properties have a broad tenant appeal and are typically easier to manage. Most beginner investors will make their initial investment in a single-family home, usually with a smaller space, such as a condo. These properties are considered low maintenance but also generate a lower amount of rental income.

However, single-family homes of any size typically attract long-term clients, with families and couples considered to be more desirable tenants as they are seen to be financially stable.

2. Multi-Family Units

Multi-family units help diversify risk and typically offer a higher rental income as the investor will purchase or lease the building, dividing it into multiple units and earning rental income from each. Alternatively, an investor will purchase at least two units in a property, renting them out to different tenants, creating multiple rental income streams.

This type of investment property is considered one of the main types of commercial real estate, alongside retail, industrial, and office properties. Investors who focus on multi-family units can increase their net operating income (NOI) by increasing the average rent in the building and increasing the occupancy rate. An investor may choose to renovate a building to add additional units.

3. Commercial Properties

Commercial properties are one of the most attractive asset classes and include several subcategories, such as hospitality, retail, and office spaces. The market for commercial properties is still changing post-pandemic.

While the market for office spaces has evolved due to remote working, there are other types of commercial properties investors can explore. Retail units and commercial spaces for business usage have a higher risk profile but lead to higher returns. Different commercial properties have their individual costs and demands associated with them.

Most investors will get experience with residential properties before they start exploring opportunities with commercial properties.

4. Vacation Rentals

Vacation rentals are an ideal type of property investment for those looking for a second property or to earn a higher rental income, think AirBnb or Vrbo. These properties offer short-term rentals with the investor setting having the freedom to choose the terms of the rental agreement. Many investors set a minimum rental duration and a maximum occupancy capacity.

Areas that attract a high number of tourists may generate more income with vacation rentals than traditional residential rentals. Investors will want to consider seasonal demand, which will be reflected in the prices they charge during off-peak and on-peak to continue generating revenue. An investor could purchase a second property and live in it during part of the year, while also earning additional rental income by renting it out during the high season.

5. Fixer-Uppers

A fixer-upper is considered a ‘flipper’ property as the investor will purchase a distressed property, or property with potential, at a lower cost and renovate it before selling or renting it for a profit within a short timeframe.

These properties can feel daunting for a first-time investor but have a lower entry point as they are more affordable. However, investors will have to consider potential renovation costs and the work involved to make the property market-worthy.

Find a Good Investment Property with Privy

An investment property can generate passive income, grow your portfolio, and provide financial freedom. Getting started in the real estate industry begins with finding the right property type for your investing profile. Research and due diligence is crucial to finding a good investment property.

At Privy, you’ll find profitable real estate investments with just the click of a button. Narrow your search by specific property types and explore real estate markets like a local. Get started with Privy today and explore more advice and resources for investors by visiting the Privy blog.