•

Mastering Real Estate Investing : The 1% and 2% Rules

Understanding how to be successful in the constantly evolving and ever fluctuating real estate industry can be overwhelming, especially as the market changes and consumer…

Understanding how to be successful in the constantly evolving and ever fluctuating real estate industry can be overwhelming, especially as the market changes and consumer needs shift. If you’re an investor, it’s important to establish a framework for your real estate investments. While there are no hard or fast rules for investing, there are strategies you can use to evaluate the potential success of an investment property, evulating it’s value as arental property.

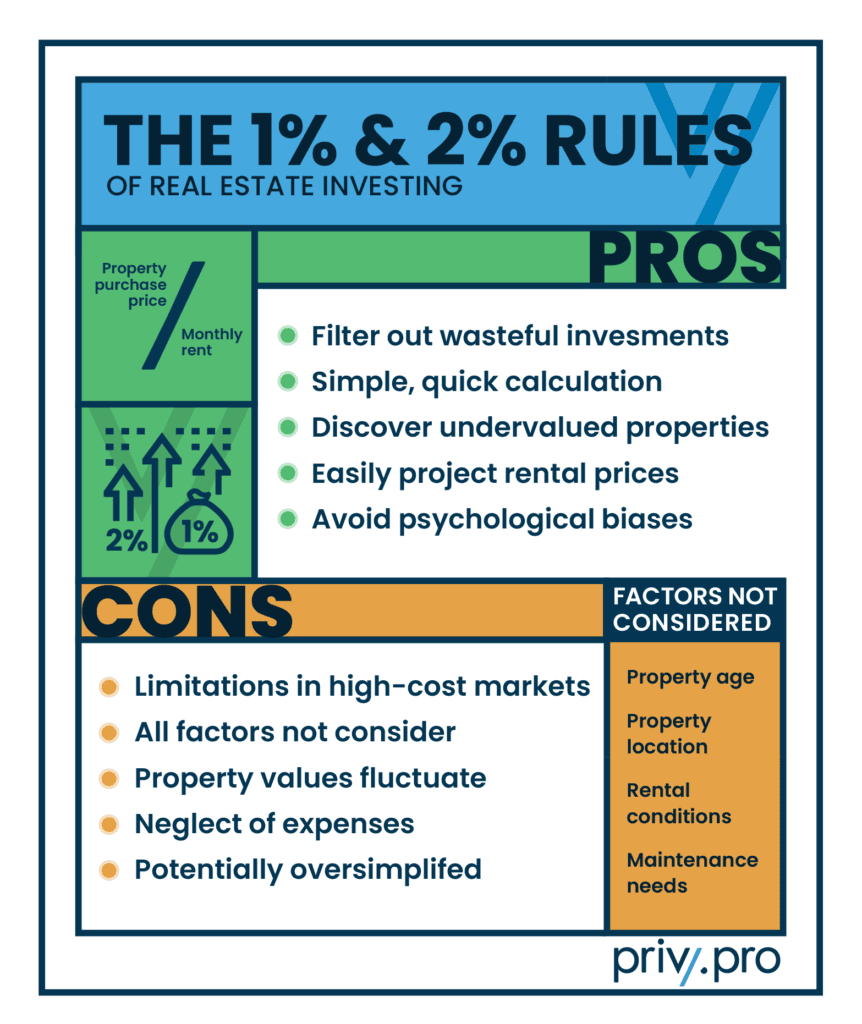

These strategic guidelines suggest that a property’s gross monthly rent should be 1% or 2% of its purchase price and are known as the 1% and 2% rules in real estate investing. Using the 1% and 2% rule enables investors to assess whether a potential investment is right for them. However, it’s important to consider other factors, such as the local real estate market conditions, renovations and necessary repairs, and operating expenses, to get a full-picture perspective on your potential investment opportunity.

At Privy, our comprehensive real estate investing platform helps you find your next long-term rental property. Our intelligent investor filtering and analysis minimize risk and maximize profit on every investment, doing the proforma projections that the 1% and 2% rule provide. Understanding the 1% and 2% rules and learning how you can utilize them as an investor or an investor-focused agent allows you to make more informed decisions about the projections you are making on your rental properties.

What is the 1% Rule?

The 1% rule states that a property’s t the property’s monthly rental income should be at least 1% of the property’s purchase price. The 1% rule is crucial as it ensures that the rent will cover the property’s monthly mortgage payment and other expenses. Investors should utilize the 1% rule to ensure they at least break even with their property investment.

The 1% rule is not possible in every market, particularly in low-cost markets where the average rent is lower. Therefore, the 1% rule is mostly applicable to real estate markets with high property prices and lower rental yields. The 1% rule should also be considered in the context of the local real estate market, operating costs, and additional factors, such as property taxes.

Calculating the 1% Rule

The 1% rule uses a basic formula type: the monthly rent should be 1% of the purchase price. For example, if a property costs $150,000 to purchase, the monthly rent should be at least $1,500. The 1% rule helps investors quickly determine whether the property would generate sufficient cash flow based on expenses and other factors to ensure a positive ROI.

Investment Properties and the 1% Rule

It’s important to consider the 1% rule as a conservative measure to ensure positive cash flow and act as the minimum rental price necessary for a property. There’s a question as to whether the 1% rule is still feasible in today’s market as prices rapidly increase. As prices rise, it’s becoming harder for investors to find rental properties in desirable areas where the 1% rule will work within exisitng market conditions. This is often an exciting challenge for real estate investors and reason to explore new markets and trending metros, like Columbus, Phoenix, and Kansas City.

What is the 2% Rule?

Comparatively, the 2% rule offers the same framework, but suggests that a rental property’s monthly rent should be at least 2% of its purchase price. This investment strategy is a guideline that enables investors to evaluate the potential profitability of a property when doing their due diligence. The 2% rule prioritizes profitability and cash flow to generate enough income to provide a positive ROI and cover expenses related to the property.

Utilizing the 2% rule can enable investors to build a profitable real estate portfolio, mitigating some financial risks. The 2% rule originated with traditional stock market investments but now serves as a useful framework for the real estate market.

Calculating the 2% Rule

Similar to the 1% rule, the 2% rule uses a simple formula stating the monthly rent should be 2% of the purchase price. For example, if a property costs $100,000 to purchase, the monthly rent should be $2,000. The 2% rule helps investors quickly determine whether the property would generate sufficient rental income to support cash flow based on expenses and other factors to ensure a positive ROI.

Investment Properties and the 2% Rule

Rental properties following the 2% rule typically have higher rents with lower property costs. These properties are also attractive to investors due to their appreciation potential. Therefore, investors should use the 2% rule when they’re looking at markets with higher rental yields and lower property price, including emerging markets.

It’s important to consider the 2% rule as a litmus test to narrow down potential investment properties. Investors need to consider other factors, such as long-term appreciation, repairs, and operating expenses, before determining if the property is right for them. Consider the 2% rule as a benchmark towards making data-driven decisions and minimizing the potential risk of deals that can return a negative ROI.

Comparing the 1% and 2% Rules for Real Estate Investments

While the 1% and 2% rule are important to understand, they should not be treated as an ironclad investment strategy by investors. They serve as a tool to evaluate the potential of a property and whether it’s a feasible investment. Utilizing the 1% and 2% rule can help identify potentially undervalued properties, but these calculations should be considered in the wider context of the property and associated costs.

Properties that meet the 2% rule are considered attractive to potential investors. When comparing the 2% and 1% rule, it’s important to consider market conditions, investment goals, and practical considerations. Investors with a lower risk tolerance should choose the 2% rule over the 1% rule.

Practical Considerations for the 1% and 2% Rules

It’s best to consider the 1% and 2% rule as being a starting point when determining the feasibility and suitability of a property. The purpose of these is to ensure that the minimum monthly rent will meet the costs associated with the property, with the 2% rule ensuring a positive return on investment.

Factors that should be considered for property evaluation include:

- Operating costs: The problem with the 1% and 2% rule is that they don’t consider the costs associated with operating a rental property. Investors must consider their expenses, including insurance, repairs and maintenance, property taxes, utilities, and legal fees.

Determining the operating costs is crucial to ensuring a positive return on investment. Estimating these costs will ensure an investor can estimate the net operating income (NOI) to determine cash flow and a potential ROI. Underestimating the operating costs of a property can result in investors failing in their due diligence and carrying a higher risk burden as a result. - Property condition: Even if the property is in a high-demand area, it may not adhere to the 1% or 2% rule if the property is in very poor condition, especially when compared to nearby property inventory . Similarly, an investor will need to make a larger initial investment and consider this cost on top of the property purchase price when using the 1% and 2% rule.

Investors should consider the age of the property, its fixtures, and any necessary repairs when determining if they can realistically charge a 2% rental rate. - Local rental market: It’s crucial to understand the local market, as this will determine whether it’s feasible to use the 1% or 2% rule. For example, in cities where the average home value is over $1 million, it’s almost impossible to apply the 1% rule as average median incomes do not facilitate this.

Exceptions can be made for high-value properties, but most investors will not be purchasing these rare exceptions. Other aspects of the local market to consider are vacancy rates and the median rental cost for similar property sizes.

Is the 1% and 2% Rules Still Relevant?

The reality of today’s real estate market is that the 1% rule and the 2% rule is not as feasible as it once was. The changing real estate landscape means that rapid price appreciation, changing tenant preferences, and investor diversification strategies mean that the both the 1% rule and 2% rule aren’t always a realistic option for certain properties.

In most markets, rental property costs have increased at a faster rate than rents, particularly due to wages and salaries becoming stagnant. Therefore, it’s increasingly harder to meet the 1% or 2% rule. The required rent needed, especially to meet the 2% rule is out of reach for most renters and is not reflected in the wider local market.

The ups and downs of post-pandemic interest rates, can negatively impact simplet one-size fits all strategies like the 1% and 2% rule. Lower intital investments, including loan interest rate, dictate a lower expected rent, but that can fluctate if interest rates are not locked in through the sale process. .

Rental tenant preferences are also changing, with renters prioritizing lifestyle considerations and additions like amenities. These changes are reflected in the real estate market’s development surge and have made it crucial for investors to diversify their investment strategy. A property with a higher rent-to-value ratio can offset lower returns from a property with a smaller rent-to-value ratio.

Other Tools to Use for Property Evaluation

The 1% and 2% rules should not be considered in the absence of other calculations or software. These strategic guidelines enable investors to quickly determine whether a property is worth exploring further without investing time or money in considering it further.

An investor can gain a more nuanced perspective on rental properties by considering these factors:

- Gross rent multiplier (GRM): This calculation works on a ratio of the property’s purchase price and its gross annual rent. If a property is $100,000 with a yearly gross annual rent of $10,000, it has a GRM of 10. The lower the GRM is, the more lucrative the investment is.

- Cash flow analysis: Cash flow is crucial for an investment strategy. It shows the difference between the monthly rent and monthly expenses, such as operating costs and insurance. Investors need a positive cash flow to ensure their investment is feasible and that they have liquidity.

- Net operating income (NOI): The annual profits for a real estate investment can be calculated by deducting operating expenses from rental revenue before accounting for mortgage payments and taxes. A positive NOI ensures enough revenue is being generated from the rental cost to meet operating expenses.

- Future value analysis: Investors should assess the potential future value of a property by considering potential zoning changes, future nearby infrastructure projects, and local rental market trends.

- Cap rate: The cap rate is calculated by dividing the NOI by the purchase cost of the property. Higher cap rates suggest a better investment; however, it can also indicate a higher risk burden.

Investors should consider the 1% and 2% rules in the wider context of the above calculations to feed into their investment strategy.

Choosing the 2% vs. 1% Rule for Rental Properties

The 1% rule has become a more realistic option for investors than the previously preferred 2% rule. It’s becoming increasingly difficult for investors to find properties that can meet the 2% rule due to rapid property value appreciation, growing beyond rental prices in most markets. Using the 2% rule in some cases would make rent unaffordable and leave investors with properties they’re unable to cover the operating costs for.

By comparison, the 1% rule is more attainable in most markets and ensures that properties are financially viable. High-cost markets with low-yield renting sectors are ideal for conditions for the 1% rule. Utilizing the 1% rule as part of your investment strategy can lead to better portfolio diversification, driving investors to consider a wider range of opportunities and property types.

Investors who prioritize properties that can generate at least a 1% monthly rent price will minimize their risks and achieve sustainable returns. Although the 2% rule may seem more appealing from a number’s perspective, the 1% rule is a pragmatic option for ensuring data-driven decision-making for investors.

Using the 2% and 1% Rules for Investment Due Diligence

Whether you’re an investor who is just starting out, or one who is constantly growing your portfolio, the 1% and 2% rules are crucial benchmarks to narrow your search for potential investment properties. As the real estate market continues to evolve, investors must take a broader view when considering properties, including the local rental market, and operating costs.

Privy can take your property valuation one step further with our intuitive algorithm that pinpoints profitable opportunities in seconds. Our actionable insights turn real estate possibilities into profit. Get started with Privy today and explore more advice and resources for investors by visiting the Privy blog.