•

Predictive Analytics: Spotting Real Estate Deals Before the Competition

No two deals are ever the same when investing in real estate. The market is full of ups and downs. As a real estate investor,…

No two deals are ever the same when investing in real estate. The market is full of ups and downs. As a real estate investor, dealing with the unexpected is part of your journey – but you don’t have to go into the process completely blind.

Predictive analytics helps surface potentially profitable properties earlier by using data from past investor activity, market trends, and property-level insights.It’s like having an inside track into where a local real estate market is going next. While it’s not a crystal ball, predictive analytics can help you make more informed decisions, backed by Privy’s investor-focused data, and spot hidden opportunities – all while getting the latest market trend forecasts.

How does it work? Predictive analytics leverages statistical algorithms, historical data, and machine learning (ML) to give you localized insights. Being able to spot real estate deals before your competition can help you secure more lucrative fix-and-flip deals or spot emerging markets before other investors start pushing up the market price.

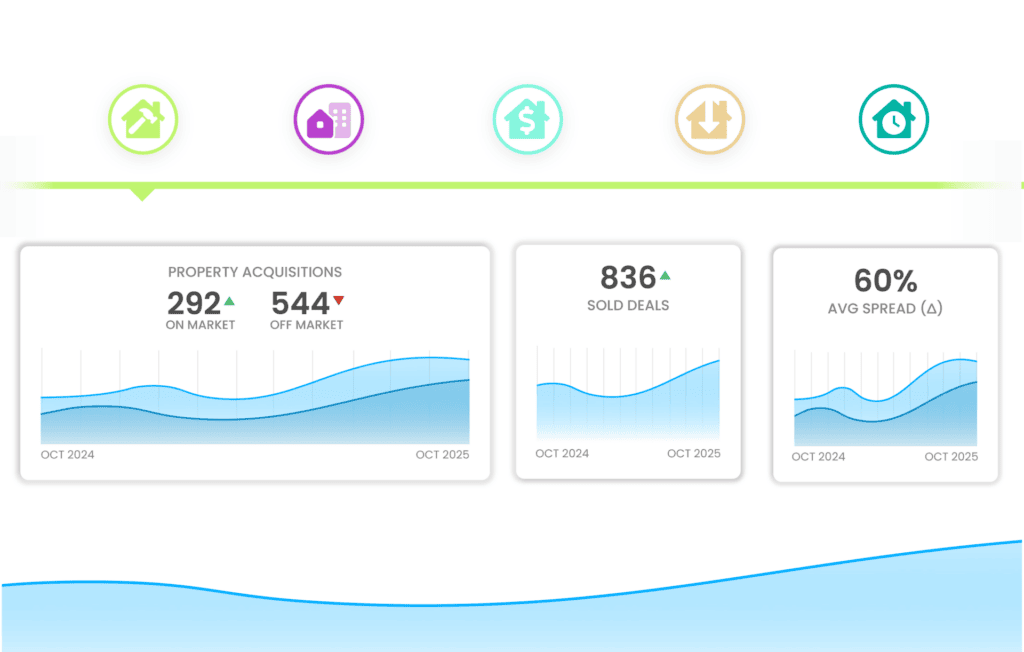

At Privy, our real-time investor activity data give you the tools to uncover investment-grade opportunities faster than traditional search methods.. Read on to find out how to incorporate predictive analytics into your investing strategy.

What Are Predictive Analytics?

If you want to make money buying and selling properties, you need to be using predictive analytics. On a basic level, predictive analytics is different types of data science and machine learning, such as statistical models that help forecast real estate trends and identify potential investment opportunities.

It can identify patterns by gathering data from different sources, including using economic indicators. Predictive analytics can forecast changes in property demand, rental rates, and market appreciation by analyzing patterns in economic, demographic, and investor activity data.

Utilizing this type of ‘big data’ empowers you to make data-driven decisions, optimizing your cash flow and mitigating potential risks. You can leverage predictive analytics using neighborhood-level data, ideal for small towns and up-and-coming areas.

The Role of Predictive Analytics in Real Estate

We’re seeing the impact of AI and data in almost every aspect of our lives – and real estate is no exception. Predictive analytics help to identify market trends and patterns by using existing data like neighborhood statistics, economic indicators, and historical property prices. It can also account for local market factors, such as ongoing infrastructure projects, crime rates, and amenities like available school places.

Predictive analytics doesn’t just help you spot lucrative deals, it also reduces your risk of entering investment situations with the possibility of negative cash flow. This comprehensive data and machine learning is also used by investor-focused agents to better understand their local market and identify opportunities for their clients.

The role of predictive analytics in real estate is constantly expanding and has the potential to positively impact every stakeholder – from real estate investors to sellers and developers.

We’re breaking down the different ways predictive analytics can be used for specific real estate stakeholders.

Real Estate Investors

Predictive analytics give investors localized data, including on neighborhood-level performance, enabling them to identify high-return opportunities and avoid spending time on areas with higher risk profiles. If you’re aiming to diversify your portfolio, predictive analytics is the best tool to have in your strategy.

Investors who incorporate predictive analytics can reduce risk and improve targeting by focusing on data-backed opportunities aligned with successful strategies used by other investors.This data helps to optimize real estate investing, including identifying potentially high-performing properties and areas with low vacancy rates.

Predictive analytics can also help investors who focus on the rental market by providing insights into tenant turnover, rental rates, and forecasting maintenance needs to maximize cash flow. Machine learning and comprehensive data help investors plan for resource allocation and property management.

Real Estate Agents and Brokers

It’s not just investors who can benefit from using predictive analytics. Agents and brokers operating in time-sensitive and competitive markets can use these forecasts to secure the best pricing for their clients.

It can also facilitate a better understanding of property trends and local buyer behavior. Investor-focused agents can use predictive analytics to narrow their search for suitable properties by using these data-driven insights and forecasts.

Homebuyers and Sellers

One of the main ways predictive analytics is used in the real estate market is to provide accurate property valuations. These insights help with market timing predictions, enabling sellers to identify when it’s the best time to sell their home and for buyers to decide when to make an offer.

Using data and machine learning removes the uncertainty that first-time homebuyers and sellers often face, while also helping parties on both sides of a real estate transaction to save time and money. Machine learning can also further protect buyers and sellers by detecting potentially fraudulent activities, such as identity theft and mortgage fraud.

Builders and Developers

Builders and developers use predictive analytics the same way as real estate investors, including those who do full-time real estate investing. These insights help developers evaluate market momentum, zoning trends, and population shifts to target areas with long-term growth potential.

Developers will also look at data like population growth, infrastructure, and local economic trends to ensure they’re following population movements without overbuilding. Just like investors, these stakeholders can use predictive analytics to make more efficient investment decisions and development planning.

Examples of How Predictive Analytics are Used in Real Estate

It’s easy to assume predictive analytics is just for getting the best price on a property. As AI, machine learning, and data forecasting continue to become more widespread within real estate, we’re starting to see it play a role in almost every part of the industry.

As an investor, predictive analytics can help you beat the competition before and after securing your chosen property. Here are 9 examples of how predictive analytics is being used by investors:

- Better Property Valuation

By analyzing historical data, market trends, and other insights, predictive analytics supports more accurate property valuations to enable investors to find below-market deals and make better pricing decisions.

- Property Demand

Predictive analytics uses rental trends, employment data, migration patterns, and investor activity to forecast demand and property appreciation. These insights enable investors to make better long-term investment decisions, particularly for single-family residential (SFR) properties and long-term rentals.

- Investment Analysis

If you’re a first-time investor, predictive analytics can give you the confidence that you’re making the right decision by analyzing your strategy. This comprehensive data and forecasting mitigate risks and identify potential deals before other investors can find them. You can get insights into market trends, rental income potential, and long-term property value appreciation.

- Pricing Optimization

Investors who focus on rental properties can leverage predictive analytics for pricing optimization, maximizing their cash flow without pricing out potential renters. By analyzing the dynamics of a local market, it can balance your pricing strategy in a way that accounts for competitors and consumer behavior to stay competitive.

- Risk Management

Investing in real estate is high risk for high reward. Incorporating predictive analytics into your strategy, whether you’re a wholesaler or a seasoned investor, can help you spot potential warning signs of economic downturns and market volatility.

- Fraud Detection

In lending and transaction security, machine learning can flag inconsistencies in borrower patterns, identify abnormal deal structures, and detect signs of potential fraud. It can protect investors from potential financial loss and make real estate transactions more secure.

- Lease Renewals

Predictive analytics can enhance your long-term investment strategy by using variables like tenant behavior and market conditions to predict how likely your existing tenants are to renew their lease. These insights can help you decide whether to increase your rental prices or plan for potentially marketing your property in advance to reduce your risk of long-term vacancy.

The Benefits of Using Predictive Analytics in Real Estate

If you want to be a real estate investor in 2025 and beyond, you need to be using predictive analytics. These data-driven insights improve decision-making, from identifying profitable properties to pricing your property competitively when selling.

Forecasting potential investment outcomes minimizes your risk as an investor, making it faster and more cost-effective to identify below-value properties. It can also identify up-and-coming markets before they experience an influx of investors and developers, driving up property prices with a seller’s market.

Here are some of the benefits of incorporating predictive analytics into your decision-making as an investor:

- Accurate property valuation to ensure your property is priced competitively to maximize returns, boost cash flow, and attract tenants or buyers. This data can help you price your property correctly the first time to avoid long-term vacancies and optimize cash flow.

- Data-driven insights to create marketing strategies that consider the behavior and preferences of the local market. As an investor, you’ll need to market your property to ensure a fast sale or rental agreement with localized insights helping to create targeted marketing campaigns.

- Predictive analytics can aid property managers in anticipating tenant turnover, vacancy periods, and likely maintenance costs, improving NOI and tenant satisfaction.

- Predictive analytics is like having a second set of eyes on your investment strategy. It helps to streamline decision-making with real-time data insights on property performance, local markets, and consumer trends. These insights can make all the difference in competitive markets, like big cities and up-and-coming areas.

- Data insights and analytics give investors the upper hand to see where the local market is heading next. While predictive analytics can forecast market fluctuations and predict potential market saturation, it can also be used to navigate regulatory changes, empowering investors to make smarter decisions to mitigate risks.

How to Incorporate Predictive Analytics into Your Investing Strategy

Now you know the benefits and uses of predictive analytics, how can you incorporate it into your investing strategy in a practical way? Integrating big data, AI, and machine learning into your decision-making can help identify properties with high appreciation potential and analyze pricing trends on a local and national level.

When exploring potential properties, forecasting models can help you estimate your likely cash flow and return on investment (ROI). By using market trends and local insights, such as infrastructure work, investors can identify neighborhoods with signs of gentrification and potential redevelopment. On the flip side, these same data insights can help identify distressed properties and pre-foreclosure properties for investors seeking a quick sale.

As the use of predictive analytics becomes more widespread, we can expect to see more predictive modeling and geographic information systems (GIS) being used by investors and developers alike.

These insights support better investment targeting by combining economic data, investor transaction patterns, and localized indicators like time-on-market and school proximity. GIS can also consider localized data, such as a property’s proximity to amenities, location, and the characteristics of the local neighborhood to predict a more accurate property value.

Predictive analytics could soon enable investors to implement dynamic pricing strategies. These real-time insights into market demand and availability could allow investors to adjust property prices, such as for Airbnb properties and short-term rentals to maximize returns.

Investors can incorporate predictive analytics into every aspect of their investing strategy, from finding under-valued properties to optimizing pricing and predicting maintenance needs. Embracing big data and machine learning is the best way to give your portfolio a competitive edge and unlock new opportunities in different markets.

Explore the Potential of Investor-Focused Predictive Analytics with Privy Pro

Predictive analytics has the potential to revolutionize real estate investing, giving you a competitive advantage over other investors in every market. Machine learning, comprehensive data, and market forecasting provide more accurate property valuations, demand forecasting, and market trends. Incorporating predictive analytics into your investing strategy is easy as a Privy investor, empowering you to work smart with data-driven insights.

Privy provides comprehensive data and insights to help you identify and analyze real estate opportunities before your competition. With rental comps, advanced ROI analytics, and nationwide rental valuations, Privy simplifies the process of finding high-performing investment opportunities.

Ready to diversify your portfolio? Attend an on-demand demo to explore how Privy surfaces investor-backed opportunities in any market—from high-cash-flow metros to emerging rental zones. Whether you’re focused on a single investment strategy or looking to explore multiple property types, Privy provides the tools to analyze and execute successful deals.