•

Why You Shouldn’t Dismiss MLS Data: On-Market Deals Are Still Profitable

There are a lot of misconceptions about on-market deals. While looking off-market might take you off the beaten path, away from the competition, it doesn’t…

There are a lot of misconceptions about on-market deals. While looking off-market might take you off the beaten path, away from the competition, it doesn’t mean you’re guaranteed a quick sale or a profitable deal. Successful real estate investors always want to be one step ahead and think creatively about their investment strategy. Luckily, you don’t have to reinvent the wheel to succeed in real estate investing. What you need is the right data communicated in the right way.

Direct, real-time MLS data makes on-market deals profitable, giving you the micro and macro market insights needed to determine the true valuation of a property. Privy’s MLS data feeds give users access to comprehensive property listings and offer data coverage of up to 98% of the United States. Real estate agents and investors can also explore market trends and local hot zones to stay ahead of the competition.

While there is value in some off-market methods, don’t fall for the hype around all off-market deals; there are still plenty of profitable on-market deals on the MLS. There are so many myths about on-market deals, from too much competition to limited profitability and availability, but with Privy’s real-time transactional data, you’ll havethe best software available to see listings as soon as they hit the market.

Better understand the value of MLS data for real estate investors and how profitable on-market deals can be in 2024 and going into 2025.

What is MLS Data?

The Multiple Listing Service (MLS) is an online database that real estate agents use to share detailed property information. Local and national agents rely on MLS to connect buyers with available properties. The property details in the MLS are typically provided by sellers or brokerages, making it a key tool for agents to find and share listings.

Every real estate investor can benefit from MLS data and having access to on-market deals. MLS data provides access to up-to-date property listings, market trends, and detailed information not listed on third-party sites like Zillow or Redfin. Investors can make informed decisions and find the best investment opportunities with better data.

Searching manually through a database is time-consuming, and most investors don’t have access to this level of information. MLS data should be the core of your tech stack as a real estate investor, providing you with up-to-date information about properties as soon as they hit the market.

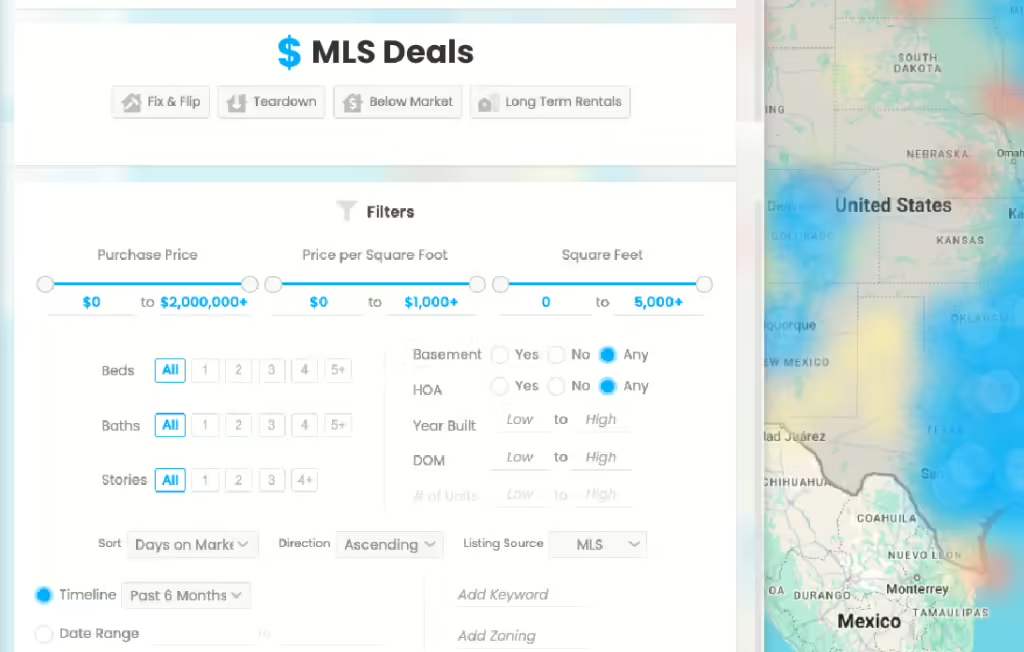

Privy acts as an all-in-one platform and a tailored solution to suit the needs of every investor, whether it’s your first or twenty-first deal. Say goodbye to hours of scrolling through listings by instantly filtering search results to match your exact investment criteria or buy box.

Privy’s Insights: Motivated Sellers on MLS

Real estate investors often fall for the misconception that motivated sellers can only be found off-market. While foreclosure and vacant properties can present opportunities for fast sales, you can find equally motivated sellers through on-market listings. Motivated sellers are people who have a reason to sell their house. If it’s being listed, the owner has reasons for wanting it sold.

On-market sellers are the most motivated. Who’s more motivated than somebody who puts a property on the market?

MLS listings are easier to work with than distressed sellers. The owner of a vacant or foreclosure property may be in dire financial circumstances and not resolved to sell their property just yet. Working with people who haven’t decided to sell their house can be challenging. It’s possible you might spend significant time and resources on a potential off-market deal that never goes anywhere.

Privy’s insights help connect you with motivated sellers using MLS data. You can stay ahead of the competition with access to first-party direct-to-MLS data. This information is usually reserved for local agents, giving you a head start for the best chance of a successful deal. Privy turns every real estate market into your local market with unique insights and networking opportunities with nearby real estate agents.

Debunking the Myth: Why On-Market Deals Are Undervalued

There are plenty of myths around on-market deals, often pushed by gurus trying to sell a course or social media membership. Historically, the gurus would teach us that motivated sellers meant that you had to go and do some form of marketing.

The motivated sellers are already waiting for you with on-market listings. These homeowners don’t need to be convinced to sell their properties. They’ve already decided and gone far enough to put their property on the market.

MLS listings can be just as profitable as off-market deals. You might make more from an on-market deal when you factor in the time and money spent chasing a potential off-market opportunity.

It’s a myth that properties are more expensive and overvalued on the listed market. There are plenty of opportunities to capitalize on undervalued properties in the market, including fixer-uppers and teardown properties. Privy uses the closest property comps and median price for on and off-market properties to identify below-market opportunities.

On-market deals are often undervalued by gurus who need to pay more attention to the importance of the legal protection and transparency offered to buyers from listed sales. You never know where an off-market deal may go, and these legal protections provide a crucial safety net for investors with portfolios of every size.

On-market deals have been undervalued because gurus and companies have created the misconception that there’s no profitability. MLS data disproves the myths about on-market deals by giving you an instant overview of properties and the ability to track deals in real-time.

Leveraging MLS Data for Profitable Deals

MLS data is the key to finding profitable deals through on-market sales. With MLS data and a platform like Privy, you can complete a comprehensive market analysis in just a few clicks.

On-market deals are profitable as the property is already on the market with a more straightforward path to closing the deal than with an off-market property. Sellers are more transparent with their properties; fast sales can happen when investors identify an ideal property or where there’s the potential for competition.

You can leverage the data inside of Privy to find the markets where an on-market strategy is more viable. Diversification is crucial to a long-term investment portfolio, especially during market volatility. Different markets, property types, and areas lend themselves better to an on-market strategy. The MLS data available through Privy enables you to navigate every market with local insights.

MLS and Privy: Combining Data for Informed Decisions

Direct MLS data has the potential to make active deals more profitable, bridging the gap between what you see in a property listing and the wider market context. Privy combines data with tested investor strategies and market insights to help investors make more informed decisions. We’re the only real estate investment platform that offers access to first-party MLS data that’s usually reserved for local agents.

Make sure you’re investing in an area that has direct-to-MLS data. We’re incorporating new areas into our coverage on a rolling basis, having recently extended our direct-to-MLS coverage to Prescott, Arizona, Northern California, and Northeast Alabama.

Privy helps you leverage MLS data to find your target property type, from long-term rentals to fixer-uppers. Our ‘Auto Deal Finder’ uses MLS data to identify teardown opportunities to expand and diversify your real estate portfolio.

It’s easy to make informed decisions and identify on-market listings that match your investor profile with side-by-side comparisons of investment strategies and extensive filtering options.

The Advantages of On-Market Deals Over Off-Market

On-market deals are as profitable as their off-market counterparts and come with advantages that can make them more attractive. Whether you’re a new or experienced investor, the security of an on-market deal and the ability to use MLS data provide valuable peace of mind.

- Motivation and Transparency: Working with Ready Sellers

You know what you’re getting into with an on-market deal. There’s no need to spend time or money convincing someone to sell their property. On-market deals allow you to work with ready sellers who have already decided to sell their property, often motivated by more reasons than just finances. For many, time and convenience are just as important as selling at a mutually beneficial price.

On-market deals are more transparent. The real estate agent acts as a third-party, and MLS data gives you an initial overview to determine if a property suits your portfolio and risk management.

- More Efficient and Less Costly than Cold Calling or Marketing Campaigns

Investors who prioritize on-market deals don’t have to spend money on marketing or the time cold calling. If you’re a first-time investor or have a full-time job, it’s not easy to find the time or resources for this sort of investment. Prioritizing on-market listings is a more efficient and less costly strategy to build your portfolio.

- Availability of MLS Data: Photos, Comparables, and Agent Information

MLS data is widely available on Privy – from photos of the property to comparables and the agent’s information. If you’re doing an on-market deal, you want to ensure you have the basic MLS information, including photos. They give you the confidence to start the ball rolling without viewing the property yourself.

Privy adds context to MLS data to show you the bigger picture and help you understand the local real estate landscape.

Case Studies: Profitable On-Market Deals

Investors across the United States have found profitable on-market deals using Privy’s insights. There’s no need for lowball offers or blind bidding when you have MLS data to find motivated sellers without the hassle of cold calling or spending money on marketing.

Markets with high investor activity enable MLS data to be used efficiently to consistently find properties at up to 60% of ARV. If you drill down on markets like Indianapolis, Indiana, all the ingredients are present to make an on-market strategy work.

Investors are already present in these markets and generating value in the local market, driving valuations up. It’s possible to submit an asking price offer and still achieve a 60% ARV on a fix and flip. It’s hard to claim on-market listings aren’t profitable when there are plenty of examples just like this.

Want to find out how to find good on-market deals on the MLS? Urban areas and those with high investor activity are the best markets to focus on. Follow our Privy ‘crack the code’ tutorial for on-market MLS deals.

Proven Strategies to Maximize Profit from On-Market Deals

On-market deals can happen within just weeks and offer ways to maximize profitability without doing all the extra work involved with an off-market deal. Here are three strategies to maximize profitability to build your portfolio through on-market deals:

- Leverage Privy to Target High-Investor-Activity Areas

High investor activity areas might seem like you’ll have more competition, but this isn’t entirely true. You want to focus on areas with large concentrations of investor activity, as that is where property valuations are actively improved. Other investors will drive up the value of the local market, positively impacting future sales prices.

- Submitting Offers at or Near Asking Price for Quick Acceptance

Skip the lowballing. On-market sellers are motivated and have their reasons for selling, but a lowball offer is more likely to often than start a conversation. Focusing on areas of high investor activity means you can submit an asking price offer on an on-market deal and still get a 50-60% ARV.

- Focus on Unrenovated Homes in Flipping Zones

If you’re looking at properties in a flipping zone, focus on unrenovated homes. You’ll often find these right down the street from a fixed and flipped home, giving a better comparable and insights.

The Role of MLS in the Future of Real Estate Investment

The Privy ecosystem is set up with exclusive insights to maximize the potential of MLS data to streamline investment opportunities with on-market and off-market properties. Privy is revolutionizing on-market deal hunting by empowering novice investors and seasoned professionals to navigate markets with local expertise.

Our MLS database includes 98% of all residential properties in the U.S., with automatic updates every 15 minutes to stay ahead of the latest opportunities. More investors rely on MLS to provide everything from side-by-side property comparisons to local market trends.

The success of on-market deals in high investor activity areas suggests this is a growing trend we’ll be seeing throughout the country, particularly in urban and metropolitan areas. Our 360-degree market analysis combines MLS data with property management information for better-informed investor decisions. As real estate investing becomes more accessible, MLS data will turn the tide back in favor of on-market listings for their transparency and tailored insights.

Find Profitable On-Market Deals with Privy’s MLS Data

Don’t believe the gurus. On-market deals are profitable, and markets with high investor activity provide the opportunity for 50-60% ARV, even with an asking price offer. At Privy, all our major features are populated with real-time MLS data to give you an instant overview of your chosen market.

Don’t overlook MLS strategies. Real-time data can help you get on a listing early and secure a lucrative deal, even in a competitive market like Indianapolis.

Privy offers all the MLS data you need for a profitable on-market deal, whether you’re a novice or a seasoned investor. Ready to get started? Schedule a demo with one of our team or attend an on-demand demo to upgrade how you invest in real estate.